personal property tax richmond va due date

8460 Times Dispatch Blvd. 3 hours agoRichmond city officials on Monday will introduce legislation to push the June 5 due date for personal property tax bills to Aug.

Henrico County Government Henriconews Twitter

9 rows Personal Property.

. At this stage you better solicit for help from. Richmond City collects on average 105 of a propertys assessed fair market value as property tax. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Personal Property Registration Form An ANNUAL filing is required on all. Personal property tax due. Delinquent real estate and personal property bills mailed.

Property Taxes are due once a year in Richmond on the first business day of July. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median value of 201800. Half of Real Estate Tax Due.

For more information on penalties is a payment or filing is received after the due date go to Real Estate and Personal Property Due DatesPenalties and. The median property tax in Richmond City Virginia is 2126 per year for a home worth the median. Penalty and Interest.

Broad Street Richmond VA 23219. Personal property tax bills have been mailed are available online and are due June 5 2022. The Treasurer will also collect interest at an annual rate of 10 from the first month following the due date until payment is made.

Parking tickets can now be paid online. Pay Your Parking Violation. Richmond City has one of the highest median property taxes in the United States and is ranked 394th of the 3143 counties in order of median property taxes.

Interest is assessed as of January 1 st at a rate of 10 per year. Personal Property taxes are billed annually with a due date of December 5 th. Thoroughly determine your actual property tax applying any exemptions that you are allowed to have.

Richmond residents will have until July 4 to pay their property taxes without penalty. Richmond VA 23225 804 230-1212. Second installment real estate tax payment due.

Personal Property Taxes. Call 804 646-7000 or send an email to the Department of Finance. The assessment is for property owned as of January 1st of each tax year.

On Monday the mayor is set to introduce legislation that recommends the Personal Property Tax payment deadline be extended to. 1 day agoCity leaders in Colonial Heights are set to extend the due date for your personal property tax bill. Department of Finance 4301 East Parham Road Henrico VA 23228.

The second due date for an outstanding tax balance is September 2 2022. Parking Violations Online Payment. The deduction for high mileage cannot exceed 40 of the normal assessed value for the vehicle.

Installment bills are due on or before June 5th and on or before December 5th. As June 5 falls on a Sunday all mailed payments postmarked on or before June 6 will avoid penalties and interest for late payment. First installment real estate tax payment due.

WWBT - As Richmond residents see an increase in their Personal Property Tax bills Mayor Levar Stoney is requesting that the due date for the payments be extended. The second due date for an outstanding tax balance is September 2 2022. Real estate tax rate set by Board of Supervisors.

Ad Get a Vast Amount of Property Information Simply by Entering an Address. If the due date falls on a weekend or legal holiday payments are due on the first business day following the due date. You must pay your personal property tax in full by the due date and be refunded the difference.

Use the myStafford Portal to search or pay Personal Property Taxes. Personal Property Tax Due Vehicle November 15. Personal Property Tax DueVehicle November 15.

Any unpaid taxes after this date will receive a second penalty. The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. If you have questions about your personal property bill or would like to discuss the value.

Mon day July 4 2022. Yearly median tax in Richmond City. In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia law that.

Mon day July 4 2022. Taxpayers can either pay online by visiting RVAgov or mail their payments. 9 hours agoRICHMOND Va.

Deadline to file real estate assessment appeal with the Department of Tax Administration. Delinquent bills due to avoid additional interest applied. Business Personal Property taxes due to the Treasurers Office.

Personal property tax payments are due December 5th of each year. The second due date for an outstanding tax balance is September 2 2022. Finance Main Number 804 501-4729.

Personal property tax bills are applicable to the calendar year in which issued. City Decal Enforcement Begins Vehicle December 5. Personal Property Taxes are billed once a year with a December 5 th due date.

Once a vehicle is established in our system as having high-mileage the reduction in assessed value will. Failure to receive a tax bill does not relieve you of the penalty and the interest on a past due bill. Click Here to Pay Parking Ticket Online.

If the due date falls on a weekend or legal holiday payments are due on the first business day following the due date. If any of the annual due dates fall on a Saturday or Sunday the due date is moved to the next weekday. Real Estate and Personal Property taxes are mailed in April and November.

May 31 2022. Personal Property taxes due to the Treasurers Office. WWBT - As Richmond residents see an increase in their Personal Property Tax bills Mayor Levar Stoney is requesting that the.

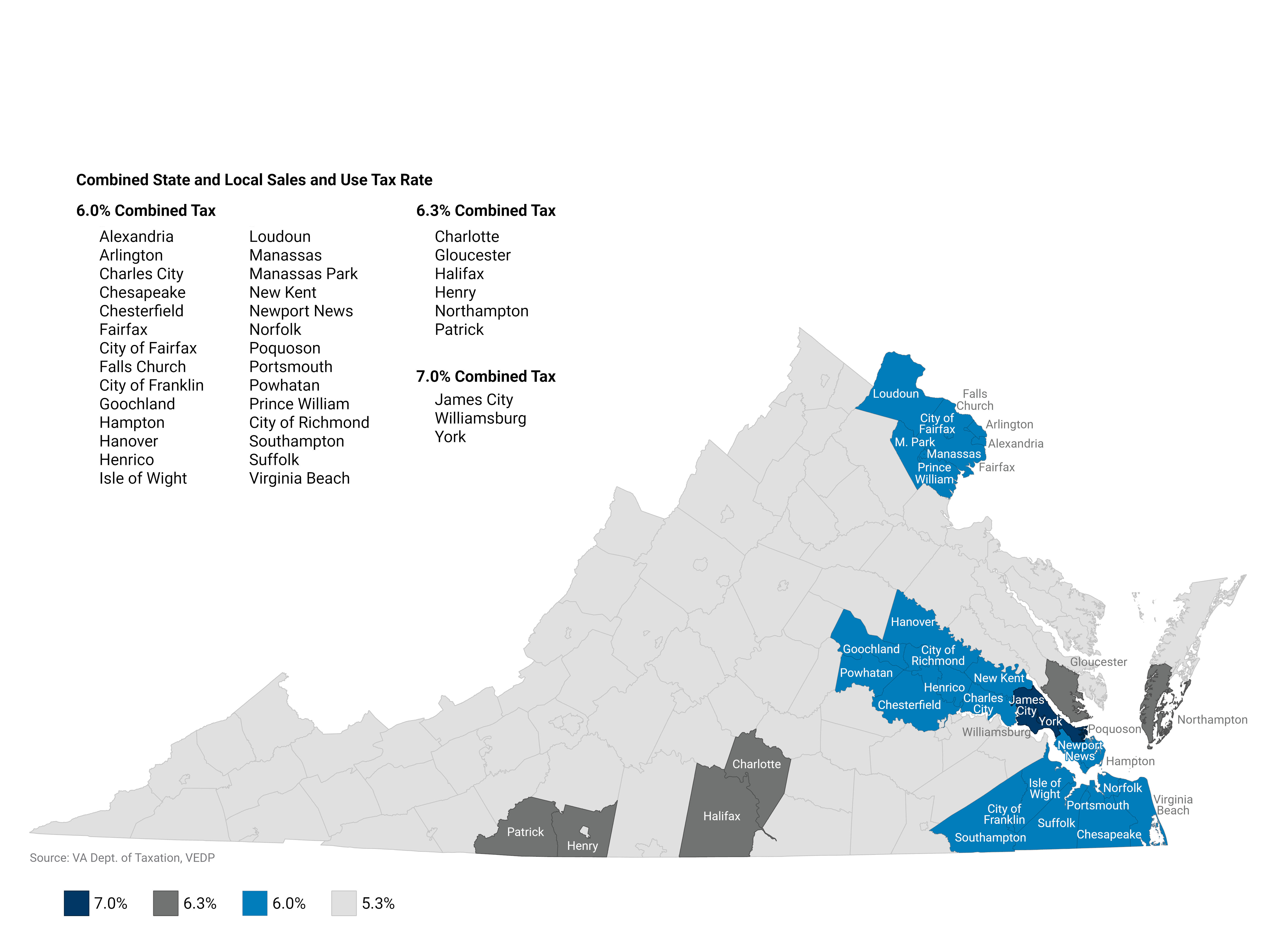

Team Papergov 1 year ago. 1st half real estate tax due. The total tax is 5 percent 4 percent state and 1 percent local A seller is subject to a sales tax on.

The 10 late payment penalty is applied December 6 th. What seems a large increase in value may actually turn into a tiny increase in your property tax bill. Half of Real Estate Tax Due.

Real Estate and Personal Property Taxes Online Payment. The Personal Property Tax rate is 533 per 100 533 of the assessed value of the vehicle 355 for vehicles with specially-designed equipment for disabled persons. Deadline to file real estate appeal with Board of Equalization.

Any unpaid taxes after this date will receive a second penalty.

Kite Day Henrico County Virginia

Many Left Frustrated As Personal Property Tax Bills Increase

Instructions For Completing Form 770 Virginia Fiduciary Income Tax

Many Left Frustrated As Personal Property Tax Bills Increase

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

Colonial Heights Expected To Extend Due Date For Personal Property Tax Bill To July 29

Real Estate Tax Exemption Virginia Department Of Veterans Services

Fill Free Fillable Port Of Richmond Virginia Pdf Forms

We Re Giving It All Back The Henrico Citizen

/cloudfront-us-east-1.images.arcpublishing.com/gray/5DJX4GFP45DOVJWLPRIWW5ETVU.jpg)

Colonial Heights Expected To Extend Due Date For Personal Property Tax Bill To July 29

Commercial And Industrial Sales Use Tax Exemption Virginia Economic Development Partnership

Henrico Leaders Push Back Personal Property Tax Deadline

Karina Bolster Karinanbc12 Twitter

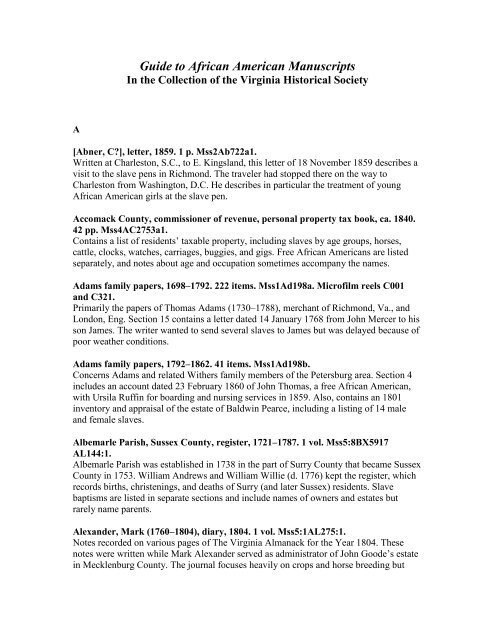

Guide To African American Manuscripts Virginia Historical Society